Special Podcast Episode

Join Brian Dijkema and Rabia Khedr identify which barriers keep people with disabilities from finding rewarding, meaningful jobs and seek ways to break down those barriers.

Executive Summary

Across Canada, people with disabilities experience significant disadvantages in the labour market. Despite decades of efforts by policy-makers to improve their access to work, employment rates for people with disabilities remain unacceptably low—and their risk of poverty is disproportionately high. In this paper, we take a closer look at the human costs of Canadians with disabilities’ exclusion from work and identify some of the key questions standing in the way of positive policy reform.

Three key assumptions inform our approach to this paper: (1) work is a fundamental human good to which all persons, including those with disabilities, should have access; (2) wherever possible, our social policy framework should be biased towards supporting work with its both monetary and non-monetary benefits; and (3) every person should receive a living wage, whether through private earnings, public income support, or some combination of the two. We review research showing that, for people with disabilities just as people without, work matters not only as a pathway to financial security but also as an important contributor to human well-being, both individual and social.

For the past several decades, policy-makers’ primary approach to people with disabilities’ exclusion from work has been to provide them with financial support. Unfortunately, this focus on standing in the income gap has not been matched by efforts to close the employment gap. Our review of federal and provincial disability-spending data for the 2019–20 fiscal year suggests that government expenditures on employment supports are dwarfed by income-assistance programs, even as poverty rates for people with disabilities remain inordinately high.

The goal toward which this paper aims is a work disability policy that recognizes and aligns with a holistic understanding of human needs—including but certainly not limited to financial security. To that end, we identify key questions relevant to disability-policy reform. We make no attempt to answer these questions here. Rather, our aim is to lay the groundwork for a productive conversation.

Introduction

Work has many non-financial benefits for people with disabilities, and most of these people are willing and able to participate in the labour market. For more than a decade, Canada has recognized work as a right for people with disabilities. However, many people with disabilities have been and continue to be excluded from meaningful employment. As a result, they have not only been excluded from the non-financial benefits of work, they also experience high levels of poverty. Policy-makers have spent decades trying to improve this situation, with little success. Employment rates remain stubbornly low for people with disabilities, while low-income rates remain stubbornly high.

In this paper, we review the benefits of work—both financial and non-financial—for people with disabilities. We then compare this research to the data on disability and employment, which reveals a troubling gap between these proven benefits of work, governments’ stated commitment to equality of opportunity in employment, and the reality of labour-market exclusion for many people with disabilities. The gap reflects a variety of barriers, not least the challenging complexity involved in designing, implementing, and evaluating effective pro-work disability policy. Our goal in this paper is to take a closer look at some of these barriers and to identify some of the key unanswered questions surrounding disability policy reform. Our approach is grounded in three central assumptions: (1) work is a fundamental human good to which all persons, including those with disabilities, should have access; (2) our social policy should be biased toward facilitating access to meaningful work and its both monetary and non-monetary benefits; and (3) every person should have secure access to a living wage that allows them to meet their basic needs with dignity—through employment earnings and/or government income support.

Our aim in this paper is not to give conclusive answers to the questions raised below. Instead, we seek to highlight some of the key work-disability policy issues raised by existing research, in the hope of stimulating further discussion. In other words, this paper is meant to be the start of a productive policy conversation—not by any means the final word.

Defining Disability

Any discussion of work-disability policy needs to begin with a clear definition of disability. Developments of the past half century are particularly important. In the late 1970s, disability advocates pushed for a fundamental change in the definition of disability. Disability, they argued, is distinct from impairment. While the latter concerns the physical or cognitive limitation of an individual, the former is properly understood as a matter of social exclusion: “[impairment] is individual and private, [disability] is structural and public.” 1Put another way, having an impairment—physical, mental, or otherwise—does not automatically lead to disability. Rather, disability emerges in environments that have been designed to serve the needs and capacities of people without (particular kinds of) impairments and therefore act as barriers to everyone else. Someone with impaired hearing, for instance, has limited capacity in a workplace where speaking and other audible sounds are the primary form of communication, but is not disabled at tasks in which no sound is involved, while mental illness may be a disability in a fast-paced workplace with high pressure and no scheduling flexibility for employees. 2

This new socio-environmental framework came to be known as the social model of disability and is now widely accepted over the impairment-centred medical model of disability. 3This paper follows the social model of disability and the International Classification of Functioning, Disability, and Health of the World Health Organization, which refers to disability as “the interaction between individuals with a health condition (e.g., cerebral palsy, Down syndrome and depression) and personal and environmental factors (e.g., negative attitudes, inaccessible transportation and public buildings, and limited social supports).” 4The employment barriers faced by people with disabilities, then, are a matter not simply of individual impairments but of the social organization of the labour market. 5

Our Working Assumptions

As mentioned above, at the foundation of this paper are three basic assumptions informed by our prior beliefs about what it means to be human. Our primary motivation in advocating for policy reform is to align public policy with fundamental human needs. As we examine in more detail below, there is a glaring gap between the stated desires of most people with disabilities, Canada’s official recognition of their right to work, the many proven benefits of work, and the reality that people with disabilities experience: consistent, widespread exclusion from the labour market. Crucially, this gap comes at a severe human cost for Canadians with disabilities, denying them the dignity and benefits (both financial and non-financial) of work. It is clear that many people with disabilities want to work and have the capacity to do so, but the current system restricts rather than supports that capacity. What makes the employment gap faced by people with disabilities such a serious problem, in our view, is that our current policy framework is failing to uphold for all people a key aspect of human life.

Our three main working assumptions are explained below.

1. Work Is a Fundamental Human Good to Which All Persons Should Have Access.

What is work, and what is work for? As we review briefly in our previous paper, “Work Is About More Than Money,” this question has been answered in many different ways. 6Given that there are competing visions of the meaning, purpose, and implications of work, it is important that we begin by stating our framework for the concept of work and labour. All our research on work is shaped by our conviction that work is integral to human dignity; this paper is no exception. We believe work is an important part of life for all people, including those with disabilities. The significance of working for human well-being is supported by a wide body of research: working offers extensive non-monetary benefits—including social, psychological, and physical- and mental-health benefits—even independent of the income attached to having a job. 7As we examine at length in the following section, this finding holds true for people with disabilities as well. Moreover, participation in the open labour market is an important part of full participation in society as a whole, and disability advocates have long insisted that exclusion from paid employment is a major barrier to broader social integration. 8In 2010, Canada formally acknowledged the importance of work for people with disabilities when it ratified the United Nations Convention of the Rights of Persons with Disabilities, which recognizes “the right of persons with disabilities to work, on an equal basis with others; this includes the right to the opportunity to gain a living by work freely chosen or accepted in a labour market and work environment that is open, inclusive and accessible to persons with disabilities.” 9

2. Wherever Possible, Our Social-Policy Framework Should Be Biased Toward Supporting Work.

Given the many human benefits of work, our policies—including those that support Canadians with disabilities—should be designed to make access to work the first resort for those they support. We believe meaningful employment is the best source of income for all people, including those with disabilities, because of the research outlined below, but we by no means believe it should be the only (or even primary) source of income in every case. Short- and long-term cash benefits are an important source of income security for those who experience barriers to living-wage employment. Nevertheless, to rely exclusively on these programs means focusing only on the financial needs of people with disabilities and neglecting the other dimensions of human life and social inclusion. Employers and governments can both write cheques used to pay for rent or groceries, but a provincial income-support program cannot provide the many additional non-financial benefits a person stands to gain from working.

Wherever possible, financial incentives for all players in the disability-policy system must align with the stated desires of people with disabilities and the human need for work—that is, policy incentives must reward work in the open labour market over long-term cash benefits. Canadians with disabilities must be rewarded for working or seeking work. The employment system must make it a rewarding option for businesses—not a more difficult one—to hire people with disabilities and to retain workers who acquire a disability in the course of their careers. Employment service providers and the benefit system’s gatekeepers must be rewarded for upskilling workers and helping them find sustainable employment, discouraging assignment to long-term government-income support in all but the most exceptional cases (even though it may be easier and less time-consuming than personalized employment coaching, vocational training, and job placement support). 10

This pro-work orientation is important because work matters to human beings. People with disabilities should have—and have expressed the desire to have—access to the dignity, social inclusion, and other non-financial benefits a good job provides. If this approach also happens to offer long-term cost savings to governments, that would be an added bonus for public balance sheets. On the other hand, if the government needs to spend more on disability programs to make access to work possible, we believe the extra investment in the well-being of people with disabilities is well worth it.

3. Every Person Should Receive a Living Wage, Whether Through Private Earnings, Public Income Support, or Some Combination of the Two.

No person should be forced to live in poverty because of barriers to employment, and one of the proper responsibilities of the government is to provide income support to vulnerable groups to ensure they are able to meet their basic needs with dignity. Yet income-support programs have too often failed to provide liveable incomes to people with disabilities, who continue to be more likely than Canadians without disabilities to experience poverty. One of the goals of this paper has been to emphasize that money is not the only thing that matters, but that is by no means to say money doesn’t matter—it does, particularly for those who don’t have enough of it to get by.

Every Canadian, regardless of his or her disability status, should be able to meet their basic needs and live with dignity above the poverty line. Where working cannot provide a viable source of income, governments should be ready to stand in the gap. Yet employment earnings and government income support don’t need to be mutually exclusive—indeed, we believe cash-transfer programs can and should encourage and support recipients in working as much as they are able. The best policy framework, in our view, is one in which cash transfers supplement employment earnings where necessary to provide a stable, reliable, living wage.

Work Matters

Work offers much more than the opportunity to gain a living, however. The financial benefits of employment are important (especially for people with disabilities), but many years’ worth of research has made it clear that work is about more than money. 11Few studies on the non-monetary aspects of work focus specifically on workers with disabilities. In the literature on disability and work, economic outcomes have traditionally received more research attention than what one group of researchers describes as “the human experience of work” for people with disabilities. 12Yet there is little reason to believe the non-monetary benefits of work (or negative consequences of unemployment) apply any less to people with disabilities, given that they “have the same needs and want similar things in their work as do non-disabled people.” 13Indeed, researchers have found that those with disabilities and those without disabilities perceive the same benefits of work. 14

Work has a positive psychological impact on the worker. This finding has been well-established in research on the general population, 15and though far fewer studies have specifically considered people with disabilities, the existing evidence suggests that the finding holds true among this group as well. A review of the research on supported employment for workers with intellectual disabilities, for example, found that work was associated with increased quality of life, well-being, autonomy, and self-esteem, as well as with lower levels of depression. 16Work offers the opportunity for personal growth. 17A number of studies have established links between employment and improved quality of life for people with disabilities, especially when work outcomes are positive. 18While much of the research has focused on paid employment, this is not the only type of work. Evidence suggests that working in other productive social roles, such as volunteering or working at home, is also linked to subjective well-being for people with disabilities. 19Losing a job (which may be a greater risk for people with disabilities given their overrepresentation in entry-level jobs with higher turnover rates), meanwhile, can be traumatic. 20

Work offers many social benefits. Though employment does not automatically guarantee new positive social relationships for people with disabilities, workplaces do offer an opportunity for social interaction and forging new connections. 21Work thus has the potential to reduce loneliness and social isolation, which are experienced at higher rates among people with disabilities. 22Jahoda et al., for example, note that “relationships at work have also been found to be significant for people with intellectual disabilities, with a link between social relationships and QOL [quality of life] in people with intellectual disability.” 23In addition, as disability advocates have long argued, employment is an important component of greater societal participation and inclusion. 24One study found a correlation between employment and a higher rate of participation in groups for people with disabilities. Notably, the positive effect of employment on group participation did not extend to people without disabilities, “indicating that the lack of employment is more isolating for people with disabilities.” 25Social integration at work can create a positive feedback loop: employees with (and without) disabilities who are able to participate in their workplaces not only are more likely to feel like accepted and valued members of the team but also increase their chances of succeeding at their jobs (both in terms of tenure and performance); 26this in turn promotes further participation in the workplace community. Perceived social support from supervisors and co-workers has also been linked to a higher quality of working life for employees with disabilities. 27

When it comes to the social benefits of work, it is important to point out that not all types of work are created equal. As Cregan, Kulik, and Bainbridge point out, “employment does not deliver equal levels of well-being to all people with disabilities.” 28Simply having a job is insufficient when it comes to reaping the full benefits of work—an employee with a disability will never experience the full social benefits a job can offer without meaningful integration into the workplace team. 29For example, disability advocates often criticize sheltered workshops and other segregated work settings for (among other issues) failing to promote social integration for their employees. Some studies suggest social belonging scores are higher for workers with disabilities in competitive employment as opposed to sheltered workshops, particularly for those with higher functional work ability. 30However, the evidence on whether integrated employment is superior to segregated employment in all cases is somewhat mixed; some researchers have suggested that it may be more important to look at intrinsic factors (like job satisfaction) rather than extrinsic indicators like physical workplace arrangement. 31

The benefits of work extend not simply to people with disabilities but to their families as well. Researchers have found evidence that working outside the home can lead to a greater satisfaction with home life for people with disabilities 32and increased quality of life for their families. 33One study found that families of young adults with intellectual disabilities who worked in open employment reported higher quality of life, even though hours worked could be quite small. 34Though a somewhat small sample size means results should be interpreted with caution, the authors stressed the importance of these findings: “The young people we categorised as attending open employment may have spent as little as 2 h a week in open employment, supplementing this time with attendance at other day occupations. Therefore, a small amount of time in open employment was associated with better family quality of life.” 35The positive effects of work and family can amplify each other: research has demonstrated that the support of families—in transitioning from school to the workforce, in job searching, in providing practical advice and encouragement—plays an important role in getting people with disabilities into the labour force and affects employment outcomes, including by mediating other employment supports. 36Researchers have documented improved outcomes for both children with disabilities and their families when these families have access to better resources and higher incomes. 37This evidence underscores the important link between support for families and support for people with disabilities—disability policy should not be separated from family policy.

Work, of course, also offers financial benefits for persons with disabilities—benefits that may be even more pronounced than they are for those without disabilities. One study estimated that despite lower average earnings among persons with disabilities, employment raised household income levels by 49 percent, compared to just 13 percent for those without disabilities. The same study also found that employment had a larger effect on a person with disabilities’ likelihood of escaping poverty, lowering poverty rates by 20 percent among the population with disabilities compared to 17 percent among the population without. 38

The financial consequences of labour-market exclusion, meanwhile, have been devastating for the disability community. People with disabilities are far more likely to experience poverty and have lower levels of household income, 39and most of this vulnerability is due to low employment rates.

Not only are working-age Canadians with disabilities twice as likely as Canadians without disabilities to live below the poverty line, but also poor people with disabilities have lower average incomes than poor Canadians without disabilities. Given the employment barriers experienced by Canadians with disabilities, it is unsurprising that the largest share of these Canadians’ incomes comes from social assistance. 40Government transfers make up nearly two-thirds (65.2 percent) of income for working-age poor people with disabilities, with just over a third coming from private-market sources (34.8 percent). 41Working-age Canadians who live above the poverty line and do not have disabilities, in contrast, receive nearly all of their income (94.8 percent) from private-market sources such as wages, salaries, and self-employment, rather than from government transfers. Even if Canadians without disabilities were poor, they still earned 71.4 percent of their income from market sources. 42For Canadians experiencing disability and poverty, government income support has come to function not as a safety net or stopgap measure to hold them over until they can return to the workforce, but rather as a long-term income replacement system 43—a system that can (and in many cases does) act as a barrier to work. It is encouraging that Canadians with disabilities have seen some improvement in their financial status in the past three decades—Fang and Gunderson found that poverty rates declined somewhat from 1993 to 2010; 44more recently, Statistics Canada reported that the poverty rate of people with disabilities fell from 20.7 percent in 2015 to 13.5 percent in 2019. 45However, the persistence of unemployment and disproportionate levels of poverty for this group remain pressing policy concerns.

The Employment Characteristics of and Labour-Force Challenges Facing People with Disabilities

Given the many proven benefits of work, it should come as no surprise that most people with disabilities say they want to work. 46While Canadian data is limited, surveys from the United States suggest the majority of non-employed working-age adults with disabilities would prefer to be employed. 47The 2004 National Organization on Disability/Harris Survey, for example, reported that nearly two-thirds (63 percent) of unemployed Americans with disabilities said they would rather be working. 48More recently, Ali, Schur, and Blanck analyzed responses to the General Social Survey, a representative national survey of American adults, and found “almost no difference between people with and without disabilities in the desire for paid work. Four-fifths (80 percent) of non-employed people with disabilities would like a job now or in the future, compared to 78 percent among the non-disabled.” 49The study also notes that non-employed people with a disability are more than twice as likely as their counterparts without a disability (42 percent vs. 20 percent) to say that they would prefer to spend “much more” time in paid work. 50Other studies have since added further evidence that “people with and without disabilities attach the same significance to work-related outcomes such as job security, income, promotion opportunities, having an interesting job, and having a job that contributes to society.” 51Research examining the experience of adults with intellectual disabilities, for instance, has found that they have the same preference for employment over unemployment—and for paid work over unpaid work—as their counterparts without disabilities. 52

Contrary to misconceptions and stereotypes, moreover, most people with disabilities have a strong capacity for employment. Though disability by definition includes barriers inhibiting full participation, many employees with disabilities have no trouble matching the work capacities of their counterparts without disabilities when provided with the appropriate accommodations. Many more have at least partial work capacity, and for some, the reduction in capacity is only temporary. 53According to the Canadian Survey on Disability, three in five (59 percent) working-age Canadians with disabilities were employed in 2017. The survey also estimated that of people with disabilities who were not working (or in school), nearly 645,000 people (39 percent of unemployed people with disabilities) had the potential to work. 54This means that three in four (76 percent) people with disabilities—the overwhelming majority—have the capacity to work.

Despite strong work potential and several decades’ worth of government initiatives to encourage their integration into the labour force, people with disabilities continue to be “disproportionately disadvantaged in the labour market.” 55 Across OECD countries, people with disabilities experience employment rates that are 40 percent lower than the overall average and double the average unemployment rate. 56Nationally, the 2017 Canadian Survey on Disability reports that among working-age adults, 59 percent of Canadians with a disability were employed compared to 80 percent of those not reporting a disability (a gap that widens dramatically when considering severity of disability, as we discuss below). 57Though many developed countries have passed legislation in the past few decades aimed at increasing employment of people with disabilities—often through prohibiting employer discrimination and requiring the provision of workplace accommodations—employment rates for people with disabilities have barely budged since the 1980s. 58

Even when people with disabilities are able to enter the labour market, research consistently finds that people with disabilities “work less, earn less, and earn lower wages when they do work.” 59Their employment disadvantages include

- fewer hours and lower wages; 60

- disproportionate employment in part-time, seasonal, contract-based, and precarious jobs; 61

- greater likelihood of holding entry-level positions with fewer opportunities for professional or economic advancement; 62and

- higher risk of involuntary job loss and being laid off during recessions. 63

Beneath these general barriers lies substantial diversity in labour-market participation, employment outcomes, and income related to the type of disability and especially the severity of disability. Though research often compares those with disabilities to those without, the heterogeneity of the population experiencing disability means there are limits to how useful these binary distinctions can be. It is at least equally as important to examine differences within the disability community, such as the nature, severity, and timing of the disability, as well as demographic factors. 64Several studies have found worse labour-market outcomes for those who acquired disability in adulthood. 65Unsurprisingly, those whose disabilities severely limit their activities are more likely to be unemployed, 66and job retention and income are lower for those with more severe disabilities. 67People with intellectual disabilities have the lowest labour-market participation compared to those with other disabilities (such as musculoskeletal or sensory), 68are more likely to work in sheltered workshops or other segregated work settings, 69and have a relatively high level of job breakdown. 70Women with disabilities work fewer hours, earn less income, and are at a substantially higher risk of poverty than men. 71

This diversity is clear in labour-market data for Canadians with disabilities. For instance, the employment gap between those without disabilities and those with mild disabilities is dwarfed by the gap between mild and severe disabilities. According to the 2017 Canadian Survey on Disability (CSD), 76 percent of working-age Canadians with mild disabilities were employed (a number very close to the overall population, which had an employment rate of 80 percent). Among those with severe disabilities, however, the employment rate fell to 31 percent, about two and a half times less than the overall population. 72Canadians with severe disabilities were also at a higher risk of poverty, being twice as likely as those with milder disabilities (28 percent vs. 14 percent)—and almost three times as likely as those without disabilities (10 percent)—to live below the poverty line. 73Age matters as well: younger and middle-aged adults with milder disabilities resemble those without disabilities in terms of employment, with around eight in ten Canadians aged twenty-five to fifty-four employed across both groups. 74Research suggests the age of onset is another significant predictor of employment. Those who become disabled during their working years are more likely to be employed (especially if they get back into the labour market soon after acquiring their disability), in large part because they have work history and experience. 75Labour-market participation also varies by type of disability. Intellectual or developmental disabilities are associated with lower employment rates: half of those with a disability related to pain or hearing are employed, for example, but only a quarter of those with cognitive disabilities. 76As these data make clear, no two Canadians experience disability in the same way, and no single policy can address the diverse labour-market barriers Canadians with disabilities face.

Common Good: The Shared Benefits of Employment Inclusion

Taken together, these employment data point to a glaring gap between the stated desires of most people with disabilities, the many proven benefits of work, Canada’s public recognition of the “right of persons with disabilities to work, on an equal basis with others,” and the reality that people with disabilities experience: consistent, widespread exclusion from the labour market. This gap does not necessarily reflect a lack of concern on the part of governments, businesses, or individuals, but rather points to the complexity of the barriers involved. Crucially, this gap comes at a severe human cost for Canadians with disabilities, denying them the dignity and benefits of work. It is clear that many people with disabilities want to work and have the capacity to do so, but the current system restricts rather than supports that capacity. The driving motive behind this paper’s focus on employment is to identify barriers that stand in the way of a policy framework more aligned with human needs and desires: to allow people who are ready, willing, and able to participate in the labour market to have access to the financial and non-financial benefits of work.

Everyone—not just people with disabilities themselves—can benefit from a more inclusive workforce. Businesses, for example, have much to gain from hiring applicants with disabilities. The business case for inclusive employment has been made by disability-advocacy organizations across Canada, including Hire for Talent; 77Ready, Willing and Able, of Inclusion Canada and Canadian Autism Spectrum Disorder Alliance; 78the Canadian Disability Participation Project and the Work Wellness Institute; 79the Canadian Council on Rehabilitation and Work; 80Rotary at Work BC; 81and the Ontario Disability Employment Network. 82The Ready, Willing and Able (RWA) initiative of the Centre for Inclusion and Citizenship, to take just one example, has convinced many employers of the benefits of hiring qualified candidates with disabilities. When RWA surveyed participating employers, 95 percent of respondents rated the employees with disabilities hired through RWA as on par with or better than the average employee, and almost two-thirds indicated that they would likely try to hire more of these employees in the next year. 83RWA’s success is all the more noteworthy given that they support candidates with autism spectrum disorder or intellectual disabilities, for whom labour-market participation is particularly low, as noted above.

Employers report that the business benefits of hiring people with disabilities include the following:

- Decreased absenteeism and turnover

- Increased punctuality and retention

- Productivity and performance equal to or better than the average employee’s

- Better adherence to workplace-safety policies and procedures

- Positive attitude toward work

- Improved workplace morale

- Excellent relationships with co-workers, management, and clients

- Positive perceptions and feedback from customers/clients 84

Nor is it only individual employers who stand to benefit from increased employment of people with disabilities: the national economy could get a significant boost as well. According to the International Labour Organization (ILO), a nation that managed to bring employment rates of people with disabilities to the same level as those of people without disabilities could experience an economic boost of up to 3 to 7 percent of its GDP. 85The International Social Security Association estimates that for every $1.00 spent on vocational rehabilitation and work reintegration for workers forced to leave the labour market due to health problems, the return on investment is up to $3.70 for employers, $2.90 for welfare systems, and $2.80 for the economy as a whole in productivity gains. 86Given that the prevalence of disability is likely to increase as Canada’s workforce ages, policy-makers and market actors have much to gain from tapping into this underutilized talent pool.

Identifying the Challenges and Complexities of Good Disability Policy

Why, then, have decades of policy innovation and investment by multiple levels of government failed to make the benefits of employment equally available to people with disabilities? In the following section, we identify some of the key questions relevant to an effective work-disability policy. This list is intended to be suggestive, not exhaustive, and to raise key questions for further consideration by stakeholders rather than provide definitive answers to them.

It is important to acknowledge that the way we define disability shapes our approach to disability policy. Since the medical model views disability through the lens of a condition impairing an individual’s body or mind, interventions based on this model focus on “fixing” the impaired individual. The social model, in contrast, views disability as arising from an interaction between the individual and his or her environment. Interventions based on this model—including those discussed in this paper—focus on addressing the disabling barriers that prevent a person’s full participation in various aspects of society. 87

How Should Policy-Makers Define and Measure Disability?

The complexity and fluidity of disability make it difficult to define and measure from a policy perspective. Since disability refers to limitations that are sensitive to environmental factors rather than a demographic characteristic, there is no single method used to identify those with disabilities in a given population. Population surveys measuring disability usually ask respondents whether they have a health condition limiting their daily living or work activities, which means that disability is effectively self-assessed. 88Most developed nations have some form of disability benefits, but relative to other elements of the social safety net like old age security, determining who is eligible for public disability benefits is subjective: age is a simple standard to determine who qualifies for public pensions, but there is no obvious or easily verifiable way to determine who qualifies for long-term disability benefits. 89This means the prevalence of disability in the working-age population is highly sensitive to the stringency of the definition of disability used, 90and that the number of people who qualify for public disability-support programs at any given point will depend on the official eligibility criteria set by the government. The experience of disability can vary significantly over a person’s lifetime, at different stages of the employment cycle, and from one place to another, which means the size and composition of the population experiencing disability are constantly in flux.

Key Questions for Sound Policy

- What is/are the most accurate and reliable definition(s) of disability for government, given its particular capacities and goals?

- How should a government measure and track the prevalence of disability in its population?

Why Are Disability-Benefit Caseloads Rising? What, if Any, Is the Connection Between Disability Policy, Unemployment Policy, and Individual Behaviour?

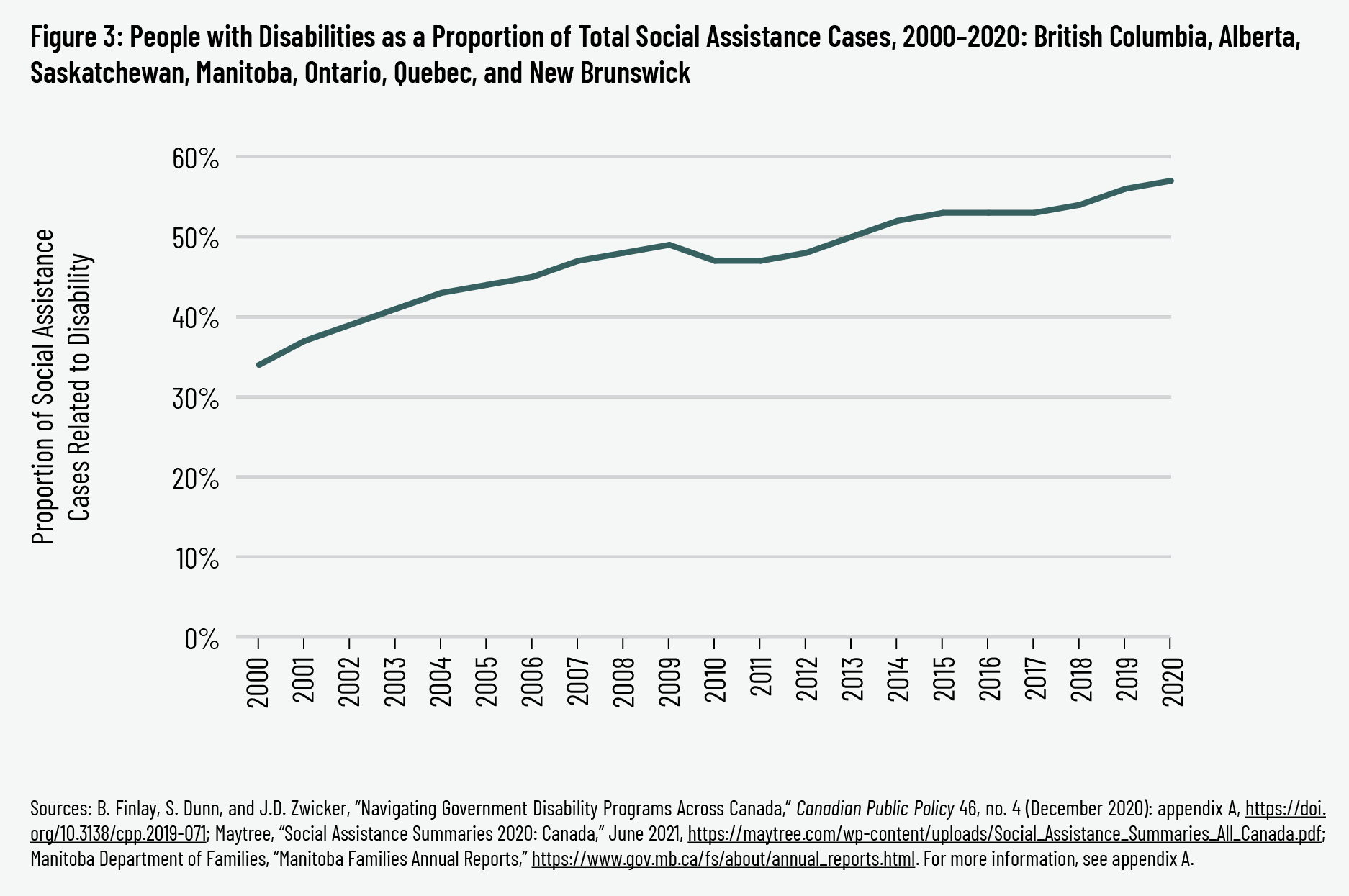

Over the past two decades, the number of Canadians receiving income support because of a disability has risen, both in absolute terms and as a proportion of total social-assistance cases. We examined caseload data for income-assistance programs in all provinces for which data were available—Alberta, British Columbia, Manitoba, New Brunswick, Ontario, Quebec, and Saskatchewan, which together represent more than 95 percent of Canada’s total population. 91Between 2000 and 2020, the number of disability-income-support cases has grown from around 382,000 to 725,000, an increase of 90 percent, while the caseload for all other social-assistance programs shrank by more than a quarter, from 747,000 to 552,000. Between the growth of disability-related cases and the decline of other cases, the share of social-assistance cases connected to disability has risen from 33 percent in 2000 to 57 percent in 2020, a 70 percent increase over the past two decades. As we examine in more detail below, it is unclear whether and/or to what extent these trends represent a transfer from one social-assistance program to another as opposed to an influx of new cases.

The rate at which the share of disability-related cases is rising in social-assistance programs varies from province to province. In Alberta, for example, cases in the Assured Income for the Severely Handicapped (AISH) program represented 47 percent of social-assistance cases in 2000 compared to 53 percent in 2020, a relatively small increase of only 13 percent. Similarly, the share of New Brunswick’s social-assistance cases in its Extended Benefits program 92has grown by a moderate 37 percent since 2001 and in 2020 made up only 28 percent of cases. In Ontario and Quebec, in contrast, the numbers are higher: since 2000, Ontario Disability Support Program and Solidarité Sociale cases have grown by 46 and 55 percent, respectively, as a share of each province’s social-assistance caseload; in 2020, 61 percent of income support cases in Ontario and 46 percent of cases in Quebec were disability related. However, the largest increase by far has occurred in British Columbia. In 2000, there were around 34,800 Disability Assistance cases in the province, representing a modest 22 percent of income support recipients. By 2020, the Disability Assistance caseload had ballooned to just shy of 110,000 cases and 71 percent of the province’s income support program—an increase approaching 220 percent on both fronts.

This pattern is consistent across other developed nations. The number of working-age adults receiving disability assistance has risen substantially both in absolute terms and as a proportion of the working-age adult population in most OECD countries in the past four decades. 93This growth cannot be explained only by changes in self-reported health or other demographic indicators, which have remained fairly stable in contrast to the fluctuation in disability-recipience rates, suggesting policy changes are playing an important role. 94

But why is this happening? Definitive answers have been elusive. Demographic trends are responsible for at least some of the increase. As the population ages, more Canadians are experiencing late-onset disabilities, and Canadians whose disabilities were present from birth or early life are living longer. 95

Yet policy also plays a significant role. Since disability is not a static state but emerges from the interaction between individuals and their environment (both of which are dynamic), disability policies affect the behaviour of affected individuals. 96It is possible that worthwhile policy initiatives could inadvertently lead to the growth of disability-benefit rolls. Anti-discrimination legislation, for example, is often designed to improve the employment security of people with disabilities by requiring employers to offer reasonable accommodations. However, another effect of the legislation might be to reduce (perceived) public stigma surrounding disability, such that some people feel comfortable identifying a previously concealed disability as the reason for their unemployment. 97Another positive development has been the increasing recognition of certain mental health conditions as disabilities. 98In either of these cases, disability-benefit rolls could grow despite—or even because of—the successful implementation of the policy.

The design of disability-benefit programs also affects behaviour, though exactly how it does so is unclear. Some research has found, perhaps unsurprisingly, that more generous benefits attract more applicants. 99Baker and Milligan, for example, examine the history of the Disability Insurance (DI) program added to the Canada/Quebec Pension Plan (CPP/QPP) in 1970. They find a strong link between program changes and the number of Canadians receiving disability insurance; the link between observed health trends and disability-benefits recipience, in contrast, was weak. Participation began increasing more sharply in 1987, the same year in which reforms were introduced to make the DI program more generous. 100The stringency of screening criteria can also play a role. Baker and Milligan observe a decline in the CPP-DI participation rate after 1995 when reforms were introduced that tightened eligibility criteria for the program. 101This observation is in line with Campolieti’s study of the Canada/Quebec Pension Plan, which found evidence to suggest that the 1987 reforms making CPP/QPP disability benefits more generous led to an increase in claims for disability from hard-to-diagnose soft-tissue and musculoskeletal impairments. 102

Moreover, disability policies interact with other policies constituting a nation’s social safety net and with broader labour-market conditions. 103These factors make it difficult for researchers to determine the precise nature of the relationship between the various disability-policy reforms of the past several decades and the significant growth in disability-benefit caseloads. Some researchers have noted that the recent shift toward a knowledge-based economy has created new barriers to labour-market participation for low-skilled workers. They suggest that the growth of disability rolls experienced by many developed countries in the past three decades might be attributable to “a combination of both an increase [in the] generosity of disability benefits and the deterioration in the labour market for low skilled workers.” 104If public disability insurance is more generous than unemployment insurance, it can create an incentive for those who acquire a mild impairment to apply for disability insurance rather than seek accommodations and/or rehabilitation. 105In 2003, for example, OECD governments spent more than double on disability programs than they did on unemployment compensation. 106As in other OECD nations, by 2010 more working-age Canadians were on disability programs than unemployment programs, and the growth in disability recipients since the early 2000s coincided with a drop in unemployment recipients. 107

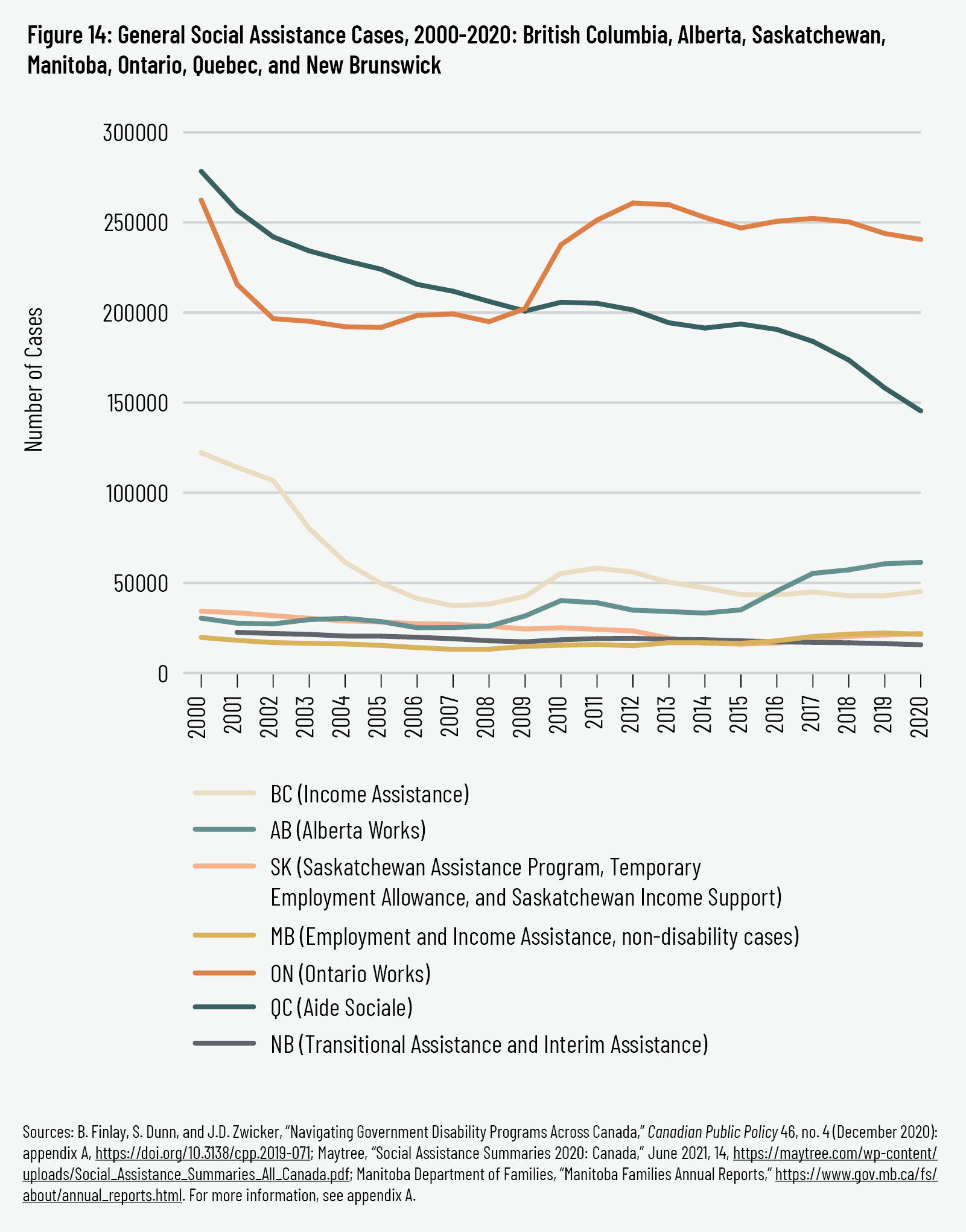

While our partial caseload data is merely descriptive and cannot imply a causal relationship between programs, they at the very least do not explicitly contradict this pattern. Disability cases have been growing as a share of social-assistance caseloads not only because the number of disability cases has been growing but also because the growth of other income-support programs has been slower or even negative. Alberta is a notable exception—the caseload for the general social-assistance program Alberta Works doubled in size between 2000 and 2020 (though most of this growth has occurred since 2015), and Manitoba also saw a modest 9 percent increase in non-disability cases in its Employment and Income Assistance (EIA) program. In other provinces, however, general income-support caseloads have been shrinking over the past two decades, falling by 8 percent in Ontario, 24 percent in New Brunswick, 36 percent in Saskatchewan, 48 percent in Quebec, and 63 percent in British Columbia. 108

Other researchers have pointed to an increasing proportion of workers in precarious—part-time, temporary, and contract-based—jobs, which do not provide workers with access to employer-triggered disability-income programs if they experience disability. Without the protection of workplace compensation programs, more workers with disabilities are forced to turn to public social assistance. 109In other words, there may not be significantly more people applying for disability benefits overall; they are simply forced to apply for benefits from different sources. In Canada, Stapleton, Tweddle, and Gibson have documented a trend in disability income systems from programs based on workforce participation—Employment Insurance sickness benefits, the disability component of the Canada Pension Plan and Quebec Pension Plan, veterans’ disability pensions, private short- and long-term disability-insurance plans, and worker’s compensation—to programs without any labour-force connection—namely, disability tax credits, the Registered Disability Savings Plan, and especially provincial social-assistance programs. 110

While the interactions between labour-markets conditions, government policies, and individual behaviour are complex, the examples above illustrate possible pathways by which passive disability-benefit programs can become a long-term (and in many cases permanent) substitution for time-limited unemployment programs. 111This can add yet another barrier to work by shifting beneficiaries from a labour-market-oriented program to one with little to no focus on workforce attachment. In addition to its negative impact on the social, physical, psychological, and financial lives of people with disabilities who say they would prefer to work, this pattern has major implications for public balance sheets. Stapleton, Tweddle, and Gibson, for example, found that spending on social-assistance disability-income programs across Canada grew by nearly 30 percent between 2005–6 and 2010–11, from $23.2 billion to $28.6 billion. 112

Key Questions for Sound Policy

- What factors are driving the increase in disability-related caseloads as a proportion of provincial social-assistance cases?

- What factors are responsible for the variation in social-assistance-caseload trends between provinces?

- Have certain policy changes contributed to the increase in disability caseloads? If so, how and to what extent?

How Should Governments Balance Spending on Financial Assistance and Employment Supports?

Government policies to support the economic well-being of citizens with disabilities usually aim to achieve two related goals: ensuring income security for those who are unable to work because of a disability, and promoting employment for those who are able to work through incentives and supports. 113Both goals are critically important. Yet despite the many benefits of work—both monetary and non-monetary—for individuals, families, businesses, and societies, as well as the significance of employment for social inclusion, work has received a dramatically lower share of government investment. Until the mid-1990s, most OECD countries made generous disability benefits a priority and put little emphasis on employment supports. Despite making some pro-work reforms in the 1990s, the balance remained skewed toward income assistance: the OECD has estimated that by 2010, nearly all OECD nations were devoting more than 90 percent of disability spending to passive cash benefits. 114Canada was no exception, dedicating only 4–6 percent of its incapacity-related spending to active labour-market programs. 115

We review federal disability-related programs and find a similar expenditure pattern for 2019–20: 116nearly $8 billion—90 percent of Canada’s total annual disability spending at the federal level—is dedicated to income support, compared to just $414 million, or 5 percent, on programs promoting employment.

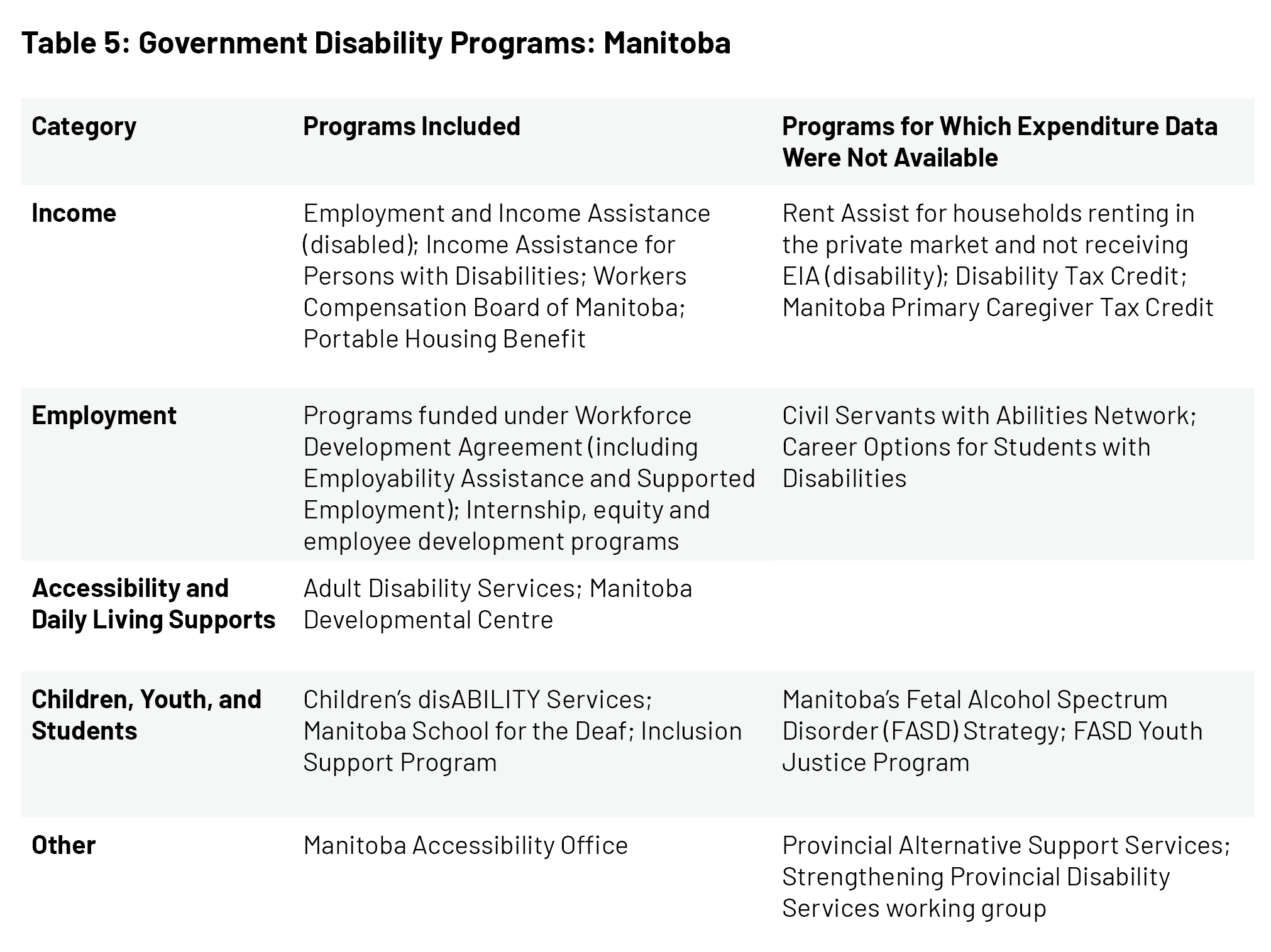

We also examine spending data at the provincial level. Our estimates reveal a similar, albeit in some cases less severe, imbalance in government spending on disability. While spending data were not available for all programs and provincial spending patterns vary, none of the provinces we examined spent anywhere near as much on employment programs as they did on income assistance. 117

Yet persistent high poverty rates among people with disabilities suggest this income-focused approach has thus far failed to achieve either goal. Has a disproportionate focus on benefits inadvertently furthered the exclusion of people with disabilities from employment opportunities that would reduce their risk of poverty? Some researchers have found a link between generous (relative to other pillars of the social safety net) disability-benefit systems and lower labour-market participation for people with disabilities. 118To what extent has governments’ default, “first-resort” approach to supporting Canadians with disabilities—that is, offering them indefinitely and in most cases, inadequate income assistance—hindered rather than helped when it comes to securing the meaningful jobs people with disabilities say they want? 119

There is some evidence from European nations’ reforms to suggest that replacing cash-oriented programs with reasonable pro-work programs will not send people with disabilities into poverty but may actually improve their economic position by allowing them to return to work (and earn income) with reasonable levels of support. 120If a pro-work policy is, as we have argued, most in line with human needs, how can income-support programs work with employment programs to advance that goal? How should various levels of government allocate public dollars across different programs to best meet the diverse needs of people with disabilities?

Key Questions for Sound Policy

- To what extent, if any, do existing cash benefit programs for people with disabilities act as a barrier to employment and long-term economic security? To what extent, if any, do cash benefit programs act as a springboard into employment and long-term economic security?

- What balance of disability-related spending—that is, between income supports, employment supports, and other programs—would allow governments to offer the most effective investment in the long-term personal, social, and financial well-being of people with disabilities?

In What Ways Does the Income-Support System for People with Disabilities Act as Both a Direct and Indirect Barrier to Employment?

Of course, developing and implementing effective pro-work policy is easier said than done. If people with disabilities are only able to find a low-paying job, lose their job, or are unable to find a job at all, they will have to turn to the welfare system to make ends meet. Yet disability-income-support programs can quickly become a significant barrier to employment. 121When income assistance is only available to those who declare themselves unable to work, it creates an incentive for recipients to stay out of the labour market in order to continue receiving the support they need to get by. In addition, many benefits are clawed back as a recipient’s income rises, which incentivizes working fewer rather than more hours. 122The income-support system thus can perpetuate a cycle of unemployment and lock recipients out of the labour market. 123The situation is further complicated by the fact that different disability income systems have different approaches to returning to work, as John Stapleton explains: “The clear irony is that contributions-based programs [e.g., the CPP/QPP disability component, worker’s compensation, private insurance] generally do not provide income support when a recipient returns to work (except through specific return-to-work incentives and limited capped allowable earnings), while social assistance, which serves people who have traditionally been too disabled to work, robustly supports entering the workplace with money, supports, and benefits.” 124

While this challenge also applies to income-assistance recipients without disabilities, it is far more severe for those whose disability involves additional expenses (such as higher health and transportation costs) and worse employment prospects. In this situation, people with disabilities often have no choice but to not work—if the only jobs available to them are precarious, low-wage positions without benefits, they may be unable to support themselves on employment earnings alone. 125Moreover, eligibility for disability-support programs is often based on impairment (as defined by medical criteria) rather than ability (as defined by the work someone is able to do). Focusing on limitations rather than work capacity pushes impaired individuals toward long-term dependence on cash transfers rather than returning to work. 126

“The primary way in which many persons with disabilities gain independence is to demonstrate serious dependence. The greater their incapacity, the more supports they receive. In short, doing worse means doing better.

“Yet the reverse is also true. Once eligible for assistance, persons with disabilities who manage to improve their circumstances typically get penalized by various programs that effectively disincentivize their behaviour. In this case, doing better means doing worse.” 127

Key Questions for Sound Policy

- To what extent do existing income-support programs for people with disabilities act as a barrier to employment and vice versa?

- Which features of these programs act as the greatest barriers to employment, and why?

How Can Policy-Makers Design Policies That Are Sensitive and Responsive to the Immense Complexity of Disability?

Even if researchers were able to clarify the relationship between policy rules and disability-benefit rolls at the national population level, the diverse nature of disability makes it difficult to measure exactly how policy changes affect the behaviour of particular groups and individuals and to design effective policy reforms if necessary. The range of disabilities that can act as a barrier to labour-market integration is diverse and spans all demographic categories, with different disabling conditions each presenting their own unique challenges based on factors like severity, type, environment, or the age of onset. 128Different types of disabilities require different policy supports, and one-size-fits-all policy will inevitably leave many people behind. 129Someone born with a moderate visual impairment will need a different set of supports than someone who suffers a back injury at work, and neither will be well served by a program designed to help those who experience severe episodic mental illness.

Some researchers suggest breaking down workers by age of disability onset since they face different labour-market challenges. 130Education and entering the workforce may be the main barriers facing those with a disability present from childhood, suggesting a strong return on policy investments in educational supports and transition planning. Those who acquire a disability during their working years, meanwhile, may have more trouble returning to work and would be better served by rehabilitative policies and accommodations. 131

Another emerging disability-policy issue is the rapidly increasing proportion of cases (and benefit claims) linked to mental health disorders. In Canada, around 60 percent of youth (age fifteen to twenty-four) with disabilities have a disability related to mental health; women outnumber men by a factor of two to one in this group. 132More than half of mental-health-related disabilities have their onset in childhood or adolescence and keep young adults in particular out of the labour force. Employment rates among those with mental illness are especially low (and unresponsive to conventional work-disability policies), even when compared to other people with disabilities. 133

Key Questions for Sound Policy

- To what extent should disability policy be targeted, and on what basis—severity, age of onset, duration, type, all of the above?

- Should policy-makers take a different approach altogether for mental-health-related disabilities? If so, should programs be differentiated even further by type of mental illness?

What Is the Appropriate Balance Between Targeting and Simplicity?

If one-size-fits-all policy errs in one direction—namely, papering over important differences—it is also possible to err in the other direction: disability programs can become so intricately targeted that they sacrifice simplicity and, more importantly, accessibility. The labyrinthine tangle of different programs currently on offer to Canadians with disabilities—along with uneven reliability across these programs—can make the support system difficult to navigate. 134There is substantial variation in the availability and accessibility of disability supports, which have been described as “a hodgepodge of public and private arrangements.” 135Eligibility can depend on age, how and when a disability was acquired, occupation, health status, the nature of the disability, or other factors. Hospital and long-term-care patients are funded through health ministries, elementary and secondary special-needs students are funded through education ministries, post-secondary students can get funds from various levels of government or their institution, and working-age adults can receive private or public insurance. 136

The province of Alberta, for instance, offers at least twenty-five programs for people with disabilities under seven different ministries. Not only do Albertans with disabilities have to navigate these programs—including determining their eligibility, applying, keeping up with program changes each year, and managing multiple supports—they also need to coordinate their provincial supports with up to another thirty-eight programs under seven ministries at the federal level (see figure 25). And this list does not even include other, more general social-assistance programs for Albertans and/or Canadians living on low incomes—a group to which people with disabilities are disproportionately likely to belong—or any programs run by the private sector.

But are accessibility problems arising from the targeting of the policies themselves, or from an under-resourced support framework that fails to connect people with the services they need? Jobseekers accessing government-funded employment services, 137for example, often discover gaps between their needs and providers’ capabilities. Relatively few provincial employment service providers have comprehensive knowledge of the particular barriers faced by jobseekers with disabilities, and those who do have specialized disability knowledge are often familiar primarily with a specific type of disability (e.g., only developmental disabilities or only addiction). 138On the income-support side, the disability tax credit (DTC)—a key benefit that also serves as a gateway to other important support programs for people with disabilities, including the child disability benefit and the Registered Disability Savings Plan—is only utilized by 40 percent of qualifying Canadians. The precise reason for low DTC uptake is unclear, but lack of awareness, a complicated application process, and unclear eligibility rules have been suggested as likely contributing factors. 139

To what extent is the lack of responsiveness in certain programs contributing to low uptake? If a policy is slow to kick in, its effectiveness is diminished. For example, the lack of early intervention to rehabilitate impaired workers and reintegrate them into the labour market significantly increases the risk of long-term-benefits dependency. 140If services are slow or unreliable, recipients may suppress concerns about existing programs for fear of reprisal or program cancellation, since “they would rather stick with something that is modestly adequate than end up with nothing at all.” 141

Key Questions for Sound Policy

- To what extent does the complexity of existing disability programs act as a barrier to access?

- What kinds of reforms would improve the accessibility and responsiveness of the current disability-support system? Would it be more effective to change the structure of disability programs themselves or to invest in navigation supports?

- Which existing disability programs are underused? Why? How could take-up for these programs be improved?

For People with Earlier-Onset Disabilities, to What Extent Are Educational Disparities Responsible for Employment Disparities?

Employment barriers for people with disabilities can begin in childhood. Inadequate government funding for educational supports often results in students with disabilities being under-prepared for the labour force, limiting their work opportunities later in life. People with disabilities have lower levels of educational attainment and job-related training, making them more likely to be left behind by the shift toward high-skilled work in developed nations. 142In Canada as in other OECD countries, people with disabilities who lack a high school education are less likely to be employed. 143Prince cites “under-resourced schools and teacher shortages for children with special needs” as an ongoing challenge to the employment prospects of Canadians with disabilities. 144The lack of educational supports may be worse for some students depending on where they go to school—in Ontario, for example, students with special needs receive no funding from the Ministry of Education unless they attend a government-run school. 145How much of the employment gap could be closed by eliminating the education gap?

Crawford argues that policies aiming to integrate people with disabilities into competitive employment should pay special attention to youth with disabilities in order to keep them from being caught in the social-assistance net early on.146 By how much could both the employment and education gaps be narrowed simply by prioritizing earlier intervention? Advocates have identified policies targeting youth and young adults with disabilities as key to preventing childhood disadvantages from limiting their long-term employment prospects. 147This includes support for special-needs students in the educational system to bridge the gaps described above. Prince also recommends improving transition planning for young Canadians with disabilities, helping prepare them for post-secondary education or employment while they’re still in high school, and expanding their access to post-secondary education (e.g., through government accommodation grants). 148

Are there certain types of disability that might be particularly responsive to youth intervention? For instance, many cases of mental illness—a rapidly growing cause of disability experienced disproportionately by younger adults—have their onset in childhood and adolescence, which suggests that providing mental health support in the education system and in transitions from school to work is critical. 149

Key Questions for Sound Policy

- What proportion of the employment gap for people with disabilities can be attributed to educational disparities?

- What kinds of educational interventions would be most effective at improving employment rates for people with disabilities?

What Kinds of Pro-work Policies Have Been Shown to Be Effective?

Even when policy-makers make closing the disability-employment gap a priority, they immediately run up against a particularly thorny question: Do we even know what initiatives actually work? As decades of little to no progress might suggest, there have been plenty of failed attempts in the history of disability-employment policy. Mont sorts pro-work disability policy tools into three categories.

- Regulations work on the demand side, imposing legal obligations on employers; examples include quotas and anti-discrimination legislation.

- Counterbalances assume that hiring people with disabilities may require greater start-up costs from employers (such as extra investments into training and accommodations) and as such work on both the demand side and the supply side by helping cover these start-up costs and increasing disabled employees’ productivity—wage subsidies or funding for the cost of accommodations (if renovations are required to improve the physical accessibility of the workplace, for example) fall into this category.

- Substitutions, such as sheltered employment, target those whose disabilities are believed to prevent them from obtaining employment in the open labour market altogether. 150

Substitutions have the worst reputation of these three types of policy tools. These policies have generally been viewed unfavourably by disability advocates because they do not promote genuine inclusion and can be susceptible to abuse. Sheltered workshops, for example, are controversial, with some researchers and disability advocates arguing that they prevent people with disabilities from participating fully in the labour force. 151Since they neither provide an inclusive workplace themselves nor help workers with disabilities transition to more inclusive work in the open labour market—few ever leave sheltered workshops—most stakeholders agree that these are at minimum less desirable than more integrative pro-work policies. 152

Though regulations are popular among developed countries, research provides limited support for these kinds of policy tools. The impact of anti-discrimination legislation, for example, is controversial and results are mixed. Researchers debate the efficacy of laws like the Americans with Disabilities Act (ADA) and whether their overall effect has been positive or negative. 153Initial studies suggested that the ADA had a negative impact on the employment rate of people with disabilities. 154Later studies challenged this conclusion, noting that more people may have been encouraged to report disability after legislation removing the stigma associated with being disabled, while others may have stopped reporting work-limiting disability when their workplaces were adapted to accommodate them better. 155The ADA was likely most effective at protecting workers from being fired after the onset of a disability, though the measured effect of anti-discrimination legislation depends on the definition of disability used in the evaluation of the policy. 156While anti-discrimination legislation can force the removal of architectural barriers, laws cannot in themselves change the attitudes of employers or the public. 157

Quotas are another popular, but controversial, regulation policy. Canada is one of the few G20 countries that does not have a disability-employment quota system, in which businesses above a certain size must have a certain percentage of their employees be people with disabilities or pay a fine. 158This policy can have the somewhat derogatory effect of implying that disabled employees were only hired to comply with legislation, not because of their competency. 159In addition, mandatory quotas often go unfilled and can be challenging for the government to enforce. 160Available evidence suggests that employment quotas have had only limited success at improving employment rates of people with disabilities. 161More promising than quotas alone is a quota-levy system, in which companies that don’t meet the quota must contribute to a fund used to support the integration of people with disabilities into the workplace. 162However, adding this kind of fund still leaves unresolved the problems observed in quota systems.

Counterbalances may be more effective policy tools when it comes to increasing the employment rates of people with disabilities. Training programs work on the supply side, helping people with disabilities reach their full work potential. Many disability-employment service providers, which provide support to individuals with disabilities in their relationships with employers and government, offer vocational-skill-development programs for people with disabilities, which have been shown to improve labour-market outcomes for young people in particular. 163While the former approach was to teach people skills and strategies for living with their disability before placing them in jobs (train first, then place), evidence now supports place first, then train. 164There is some evidence that employment programs in general, and skill matching and individualized support in particular, have a positive impact on labour-market participation for people with disabilities. 165Nevertheless, the true effectiveness of vocational rehabilitation programs remains unclear, since it is difficult to measure the impact of program intervention while controlling for selection bias (service providers unconsciously selecting those whom they believe would be more successful, or those who are more likely to find work anyway applying to the program). 166

Governments can also provide demand-side counterbalances through support for employers. Financial incentives are sometimes offered to employers to help them with the cost of providing accommodations and ensure that workers receive a decent wage: “By effectively decreasing the wages paid by employers without decreasing the income received by the disabled workers, these policies can even the playing field in the job market while still allowing workers to secure their livelihood.” 167Wage subsidies, which include both tax incentives and direct payments, are one form of financial support for employers. They are usually designed to help employers with any additional costs or uncertainties—since stability can also be crucial for employers—of hiring and training applicants who may be at a disadvantage in the labour market, including (among others) applicants with disabilities. 168

Wage subsidies may sound appealing in theory, but do they work in practice? If subsidies are too low, for example, the effect on hiring may actually be negative. 169There is evidence to suggest that wage subsidies offered in the form of a tax credit for employers are not well-used and that the effect of tax credits on hiring is limited. 170Empirical evaluations of targeted wage subsidies are scarce, not least because it is quite difficult to discern any causal effect of subsidy programs on employment rates. Selection bias, for example, is always a possibility: people who participate in these programs may be more likely to find any kind of employment than non-participants regardless of subsidies. 171Critics of wage subsidies argue they do not lead to sustainable, long-term employment in the open labour market and can reinforce negative stereotypes about the capacities and qualifications of employees with disabilities—for example, by implying that an applicant with a disability was not valuable enough to the employer to hire at the full wage usually offered for their position. 172

Key Questions for Sound Policy

- What programs have been shown to meaningfully improve the employment rates and outcomes of people with disabilities?

- Can wage subsidies ever be effective at helping people with disabilities secure reliable, well-paid, long-term employment? If so, what design features are required for a wage-subsidy program to be effective?

What Are Employers’ Responsibilities?

Up to this point, the primary focus of this paper has been the role of government and policy-makers. But when we start to ask difficult questions about policy effectiveness, the question of how much the state should do to close the disability-employment gap starts to run up against the question of how much the state can do. To what extent does the burden of improving employment rates for people with disabilities rest on employers in the private sector?

“While the government is playing an important role in helping people with disabilities . . . we can’t, and shouldn’t, do everything. The private sector must also step up to the plate, collaborating with Government and not-for-profits and communities at large.” The Honourable Diane Finley, former Minister of Human Resources and Skills Development Canada, at the release of the Report of the Panel on Labour Market Opportunities for Persons with Disabilities, January 16, 2013. 173

Several disability-policy researchers and advocates have noted the need to give more attention to the employer side. 174Prince’s policy paper argues that policies have focused primarily on supporting disabled Canadians without corresponding support to employers in hiring them. 175Torjman makes a similar argument: government investment in training and education is important, but will have only a limited impact in the absence of real employment opportunities. 176In their review, Vornholt et al. insist that employer attitudes and practices are crucial to the long-term retention and career success of employees with disabilities. 177Likewise, Burge, Ouellette-Kuntz, and Lysaght note that positive employment outcomes for adults with intellectual disabilities require employers who are willing to hire them and provide adequate support systems. 178The Ready, Willing and Able (RWA) program of the Centre for Inclusion and Citizenship intentionally focuses on the employer side to help Canadians with intellectual disabilities and autism spectrum disorder get into the labour market, and their initial reports suggest that this approach has yielded promising results. 179

Moreover, when it comes to keeping workers who acquire a disability during their working years in the labour force, the research overwhelmingly supports earlier intervention—which requires buy-in from employers. 180Those who acquire a disability partway through their working years should be reintegrated into the labour market as quickly as possible. 181The sooner someone can return to work, the less likely it is that their job skills will atrophy. 182Early assessment of impaired workers’ remaining work capacities—rather than focusing on what they are no longer able to do—is essential to maintaining and strengthening their skills. 183Meanwhile, those who start receiving long-term disability benefits are unlikely to return to any form of employment, and “the likelihood of permanent labour market exit rises exponentially with duration away from work.” 184Since it is far more effective to stop people leaving the labour market in the first place than to incentivize them to return to work after leaving, the best way to prevent people with disabilities from being trapped by the social-assistance net and to keep them connected to the human benefits of work is to slow new enrollees rather than trying to help people who are already enrolled to leave. 185

In these cases, the employer has a critically important, though sometimes undervalued, role to play in preserving the worker’s employment—preferably as soon as possible after the onset of the disability. The worker already has training and skills associated with that workplace as well as a relationship with the employer. The employer, meanwhile, knows (far better than government representatives or service providers) the person’s skills and the requirements of his or her job. 186The trust established by the existing employment relationship can make return-to-work policies more likely to succeed. Employees who need more than modified job duties or workspaces to get back on the job may be reluctant to discuss concerns about child care, health benefits, or flexible hours with a new employer. 187Personalized, robust return-to-work strategies may be particularly important for those whose disability relates to mental health. 188

Nevertheless, acknowledging that employers can and should be involved in closing the disability-employment gap provokes another thorny question: How? What would effective action by the private sector look like, and who would need to be involved to produce a good answer to that question? If and when a practical course of action for employers is identified, how could we get there? Recognizing that employers have responsibilities does not in itself answer any of these crucial questions.

Key Questions for Sound Policy

- How can/should employers contribute to closing the employment gap for people with disabilities?

- Which parties would need to be involved to develop effective, realistic disability-employment initiatives for the private sector?

- How can/should government support employers in their efforts?

How Much of the Disability-Employment Gap Can Be Explained by Discrimination?